COMPETITION, CONCENTRATION, AND EFFICIENCY: EQUILIBRIUM IN FINANCIAL MARKETS

Competition in financial sector means the degree to which consumers can shift from one service provider to another and hence he can opt out of available options in the market. Competition reduces cost, increases efficiency and brings about improvement in technology. There are many measures of competition like total number of financial institutions, changes in market share, price of services, ease in shifting from one service provider to another etc. even capital markets and non-banking financial intermediaries. Easier the entry, more is the competition and vice versa. There is lesser competition for public financial institutions than for private ones. In some cases, the shares of domestic and foreign owned institutions are important for assessing competition and incentives for financial innovations.

Concentration also indicates the level of competition. Concentration means whether market share is equally distributed amongst service providers or some service provider is dominant in the market. For example, we take three bank concentration ratios which are defined in terms of assets, deposits or branches. We see how much market share is owned by these dominant institutions. A better index is Herfindhal Index. Higher is the index, more is the concentration and vice versa. It can also be applied to different financial instruments by looking at their share in total deposits or investment. A financial system can develop sustainably when depending on the extent of efficiency in its operation. There is a high positive correlation between competition and efficiency.

Efficiency in quantitative terms can be assessed from:

(a) Ratio between total cost of financial intermediation and total assets;

(b) Interest rate spread which is the difference between lending rates and deposit rates.

Intermediation costs include operating costs, taxes, loan-loss provisions, net profits etc. interest rate spreads remain high even if service providers are efficient because of need of building loan-loss provisions or charge a risk premium on lending to high risk borrowers. In an efficient market, there is flow of information. The difference between purchase price and sale price of securities which is called bid ask spread will be used for efficiency. Bid ask spread also reflects liquidity of the market. Market depth is another indicator of efficiency. It measures the ability of the market to absorb large trade volumes without relevant effects on their market prices. We can also make use of market tightness to judge liquidity of the market. Market tightness refers to ability of the market to match demand and supply at low cost which is measured by average bid-ask spread. If market is liquid, bid-ask spread will be lower and vice versa.

CRITERIA TO EVALUATE FINANCIAL ASSETS

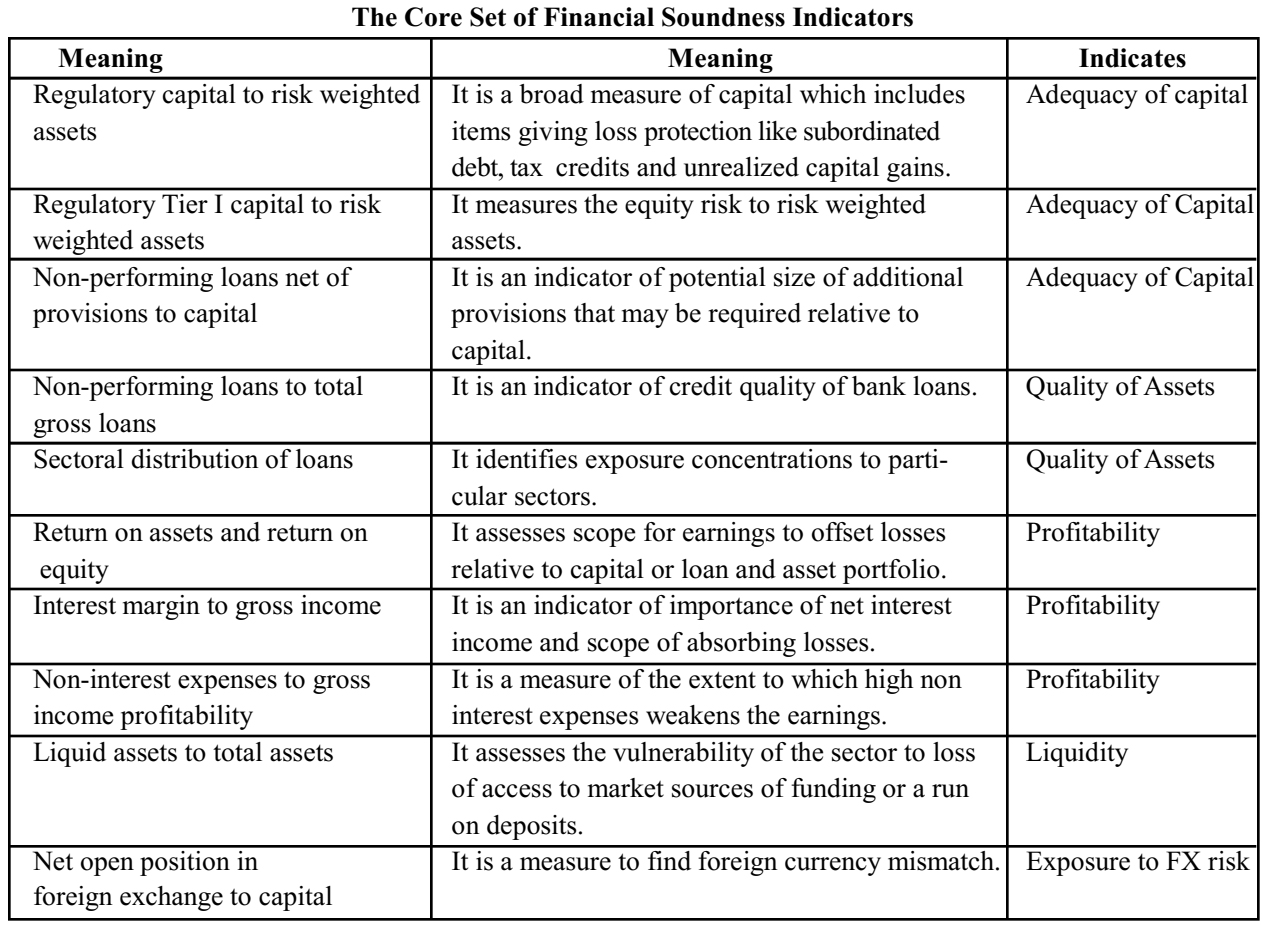

There are some indicators used to gauge the soundness of financial institutions. These are known as Financial Soundness Indicators (FSIs).

Financial Soundness Indicators

Financial soundness indicators (FSIs) are measures which are used to gauge the current financial health and reliability of a financial system. It includes financial soundness of financial institutions, their corporate and household counter parts. These include both aggregated individual institution data and indicators that reflect the market conditions in which these are operative. FSIs are relatively new statistical tools and some of their concepts have been taken from prudential and commercial measurement frameworks. We have given below a table of core set of indicators of FSIs. A detail can be obtained from “Compilation Guide on Financial Soundness Indicators (IMF-2004).”

Limitations of FSIs:

(a) These FSIs consist of aggregate balance sheet measures. When we aggregate micro prudential indicators (institution level indicators) and macro prudential indicator (FSIs), there is a loss of information. But aggregation is required.

(b) Moreover, FSIs themselves are either backward looking or contemporaneous indicators of financial soundness and are available with a lagged or low frequency. Therefore, many analytical tools are required to interpret them.

(c) FSIs can be manipulated easily as it is limitation of al statistical tools.

Therefore, one must complement FSIs with market based indicators. These are forward looking indicators and are available with higher frequency.

Financial Soundness Indicators (FSIs) for Financial Securities Markets

The stability of financial securities markets need to be judged so that investment can be encouraged. For it, we can make use of wide range of quantitative indicators that focus on market liquidity because liquidity is relevant for investors as well as financial institutions. A market is liquid if a large volume of securities can be sold in it in relatively shorter time period and without much effect on their prices. There are two indicators of market liquidity:

(a) Market tightness:

Market tightness can be defined as the ability of the market to adjust demand and supply at low cost. Its indicator is bid-ask spread. It is difference between sale and purchase price of a security. More is the bid-ask spread, tighter is the market and vice versa. A narrower spread indicates more competitive market with higher liquidity.

(b) Market depth:

It refers to ability of the market to absorb large trade flows without a significant effect on prices. Market depth is reduced if their ability to deal without having prices to move against them is reduced. Market depth can be assessed by quota sizes, on the run and off the run spreads, volatilities etc. In the table given below we have a list of FSIs grouped into a core set and encouraged set.

No comments:

Post a Comment