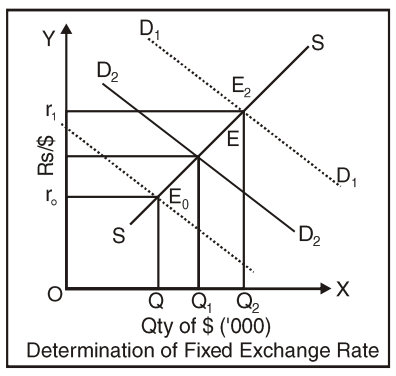

DETERMINATION OF FIXED EXCHANGE RATE

The biggest limitation of flexible exchange rate regime is that in the flexible exchange rate regime, exchange rates are highly volatile which increases uncertainties in international transactions. These uncertainties hinder the development agenda of a nation. Therefore, government makes an effort to bring about stability in exchange rate.

When a country follows fixed exchange rate regime, the government intervenes to ensure that exchange rate is maintained at a fixed rate say Rs. 40/$. Suppose that the S is the supply curve and D1 and D 2 are the demand curves for dollar. The exchange rate when supply is S and demand is D1 is Rs. 40/$. If demand for dollar increases and demand curve shifts to the right, new exchange rate will be determined at Rs. 45/$. In order to ensure that the exchange rate does not rise to Rs. 45/$, it must sell Q1Q2 dollars. And if demand for dollar decreases and demand curve shifts to the left, new exchange rate will be determined at Rs. 35/$. In order to ensure that the exchange rate does not fall to Rs. 35/$, it must buy Q1Q3 dollars.

It makes clear that if government wishes to maintain exchange rate at a fixed level, it must maintain fixed exchange reserves fro which it can buy or sell foreign exchange to maintain stability in exchange rates. To exemplify, if BOP is in deficit, it means demand for foreign currency > supply of foreign currency. It implies reserves will have to be sold to maintain stability of exchange rate and therefore, the monetary authority’s foreign exchange reserves will reduce. On the other hand, if BOP is in surplus, it means demand for foreign currency < supply of foreign currency. It implies reserves will have to be bought to maintain stability of exchange rate and therefore, the monetary authority’s foreign exchange reserves will increase.

Point to be remembered is that in flexible exchange rate regime, BOP surplus/deficit led to appreciation or depreciation of currency but in fixed exchange rate regime it leads to rise or fall in monetary authority’s foreign exchange reserves. But any country has a limited amount of foreign exchange reserves. If the disequilibrium in deficit continues for a long time, monetary authority will not be able to maintain stability in exchange rate. In that case government will have to devaluate the currency.

No comments:

Post a Comment